How Much Money Do U Have To Make To Get A Home Loan Of $150,000.00 In Arkansas

FHA Loan Calculator: Bank check Your FHA Mortgage Payment

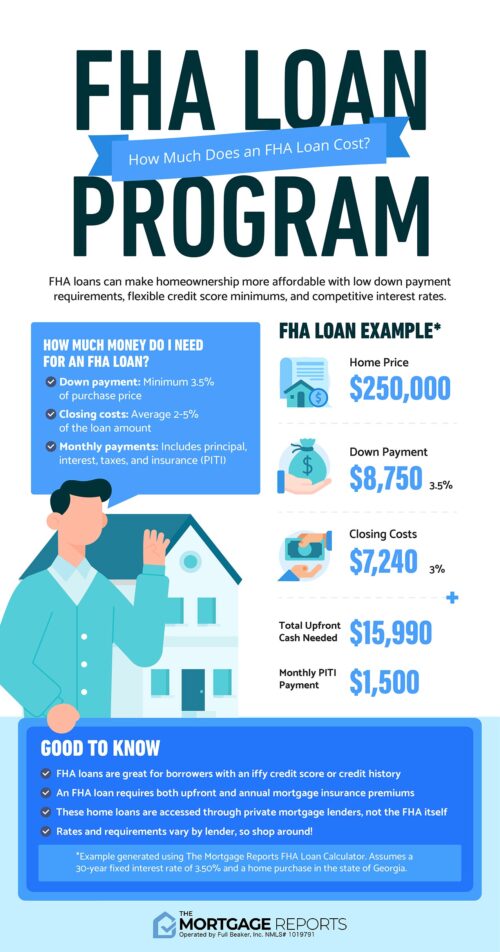

FHA home loans require only 3.five% downwards and are ultra-lenient on credit scores and employment history compared to other loan types. The starting time step to seeing if FHA tin can make you lot a homeowner is to run the numbers with this FHA mortgage calculator.

Verify your FHA loan eligibility (May 12th, 2022)>Related: How to buy a house with $0 down: Kickoff-time dwelling house heir-apparent

FHA mortgage calculator terms

Many kickoff-time abode buyers aren't enlightened of all the costs associated with homeownership.

When you pay your mortgage, you're not just repaying loan main and interest to your lender. You also need to pay homeowners insurance, belongings taxes, and other associated costs.

The FHA mortgage calculator higher up lets you estimate your 'true' payment when all these fees are included. This will help yous get a more accurate number and effigy out how much house you can really afford with an FHA loan.

Here'southward a breakdown to assistance you understand each of the terms and fees included in our FHA loan affordability calculator:

Downward payment

This is the dollar amount you put toward your home purchase. FHA features a low down payment minimum of 3.5% of the purchase price. This tin come from a downward payment gift or an eligible down payment assistance program.

Loan term

This is the fixed amount of fourth dimension you take to pay off your mortgage loan. Most home buyers choose a xxx-year, stock-still-rate mortgage, which has equal payments over the life of the loan. fifteen-year fixed-charge per unit loans are also available via the FHA program. FHA offers adjustable-rate mortgages, too, though these are far less pop considering the mortgage rate and payment can increase during the loan term.

Interest charge per unit

This is the annual rate your mortgage lender charges as a cost of borrowing. Mortgage involvement rates are expressed as a percentage of the loan amount. For example, if your loan corporeality is $150,000 and your interest rate is 3.0%, yous'd pay $4,500 in interest during the first twelvemonth (0.03 x 150,000 = iv,500).

Principal and interest

This is the amount that goes toward paying off your loan balance plus involvement due to your mortgage provider each month. This remains constant for the life of a fixed-rate loan. Your monthly mortgage payment doesn't change, but each month you pay more in chief and less in interest until the loan amount is repaid. This payment progression is called acquittal.

FHA mortgage insurance

FHA requires a monthly fee that is a lot like private mortgage insurance (PMI). This fee, chosen FHA Mortgage Insurance Premium (MIP), is a blazon of insurance that protects lenders against loss in example of a foreclosure. FHA charges an upfront mortgage insurance premium (UFMIP) equal to i.75% of the loan amount. This tin exist rolled into your loan remainder. It besides charges an almanac mortgage insurance premium, normally equal to 0.85% of your loan corporeality. Annual MIP is paid in monthly installments along with your mortgage payment.

Property tax

The county or municipality in which the home is located charges a certain amount per year in taxes. This toll is carve up into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a domicile if holding taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance

Lenders crave you to insure your dwelling from burn and other amercement. Your monthly home insurance premium is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

HOA/Other

If you lot are buying a condo or a domicile in a Planned Unit of measurement Development (PUD), you may demand to pay homeowners association (HOA) dues. Loan officers factor in this cost when determining your DTI ratios. You lot may input other home-related fees such equally flood insurance in this field, but don't include things like utility costs.

Mortgage escrow

Belongings taxes and homeowners insurance are typically paid to your lender each month along with your mortgage payment. The taxes and insurance are kept in an 'escrow business relationship' until they get due, at which time your lender pays them to the right company or agency.

Verify your FHA loan eligibility. Start hither (May 12th, 2022)FHA mortgage eligibility

FHA mortgages have peachy perks for first-time habitation buyers. Simply to use this loan program, you need to meet requirements gear up past the Federal Housing Assistants and your FHA-approved lender.

FHA loans are typically available to those who run across the following qualifications:

- A credit score of 580 or higher (lower scores may exist eligible with 10% down)

- A 3.5% down payment

- A debt-to-income ratio of 43% or less

- ane-2 years of consistent employment history (most probable two years if self-employed)

- A property that meets FHA standards or is eligible for FHA 203k financing

- A loan amount inside 2022 FHA loan limits; currently $420,680 in most counties

These are general qualifying guidelines. However, lenders oftentimes take the flexibility to approve loan applications that are weaker in one area only stronger in others. For instance, you might get away with a college debt-to-income ratio if your credit score is good.

If you're non sure whether you'd authorize for financing, check your eligibility with a few unlike mortgage lenders.

Many potential home buyers are FHA-eligible but don't know it yet.

How does an FHA loan work?

FHA loans are a home buying program backed past the Federal Housing Assistants.

This agency — which is an arm of the Department of Housing and Urban Development (HUD) — uses its FHA mortgage program to brand homeownership more attainable to disadvantaged dwelling house buyers.

FHA does this by lowering the upfront barrier to habitation ownership.

Reduced down payments and lower credit score requirements brand homeownership more accessible to buyers who might not otherwise authorize for a mortgage.

Although FHA loans are backed by the federal authorities, they're originated ('made') past private lenders. About major mortgage providers are FHA-approved, and so information technology's relatively easy to shop around and discover your best deal on an FHA mortgage.

If y'all take a sub-par credit score, low savings, or high levels of debt, an FHA mortgage could help you get into a new habitation sooner rather than later.

FHA loan limits for 2022

FHA has a maximum loan amount of $420,680 for a single-family dwelling in about of the U.S.

However, FHA loan limits increment in more than expensive real estate markets and metro areas.

Single-family unit dwelling house loan limits

- Low toll area: $420,680

- High-cost area: $970,800

The FHA defines a depression-cost surface area as one where y'all tin can multiply the median home price by 115% and the resulting price is less than $420,680.

On the other manus, loftier-cost areas exceed $420,680. In these cases, the maximum loan amount is $970,800. Nigh 65 counties in the U.S. have home purchase prices loftier enough to qualify as a loftier-cost area.

Many areas fall somewhere between the low- and high-cost ranges, with loan limits gear up accordingly.

Alaska, Hawaii, Guam, and the U.S. Virgin Islands are special exceptions and have loan limits capped at over $1 million.

Multifamily home loan limits

The Federal Housing Administration too finances mortgage loans for multi-unit of measurement backdrop.

| ii-Unit Property | 3-Unit Belongings | 4-Unit Property | |

| Low-Cost Area | $538,650 | $651,050 | $809,150 |

| High-Cost Area | $1,243,050 | $1,502,475 | $1,867,275 |

Over again these limits are college in Alaska, Guam, and the U.S. Virgin Islands.

Even though the FHA allows multi-family dwelling house purchases, you must live in one of the units as your main residence.

Verify your FHA loan eligibility (May 12th, 2022)

FHA mortgage FAQ

How much can I qualify for with an FHA loan?

FHA sets loan limits for each county, which dictate the maximum corporeality borrowers can qualify for via the FHA programme. Loan limits are higher in areas with high-price real estate, and borrowers purchasing 2-iv-unit of measurement properties can ofttimes get a larger loan amount than those buying single-family homes. Not all borrowers will authorize for the maximum loan size, though. The amount yous can qualify for with FHA depends on your downward payment, income, debts, and credit.

What's the minimum down payment with FHA?

Domicile buyers must put at to the lowest degree 3.5 percent downwards on an FHA loan. That's considering FHA's maximum loan-to-value ratio is 96.5 per centum — pregnant your loan corporeality tin can't be more than 96.5 per centum of the home's value. By making a 3.5 percent down payment, you push your loan amount below FHA'southward LTV threshold.

What happens if I put 20 percent downwards on an FHA loan?

Unlike conventional mortgages, FHA loans exercise not waive mortgage insurance when you put xx percent downwardly. All FHA homeowners are required to pay mortgage insurance regardless of down payment — though if you put at least 10 pct downwardly, y'all'll merely pay it for 11 years instead of the life of the loan. If you have xx percentage downwards and a credit score above 620, you're likely better off with a conventional loan considering you won't have to pay for PMI.

Do yous pay closing costs with an FHA loan?

Yes, you have to pay closing costs on an FHA mortgage merely like whatsoever other loan blazon. FHA loan closing costs are close to conventional closing costs: about two-v percent of the loan amount depending on your home price and lender. FHA also charges an upfront mortgage insurance fee equal to ane.75 percent of the loan amount. Most borrowers roll this into the loan to avoid paying it upfront. Simply if you cull to pay upfront, this fee will increment your endmost costs substantially.

What'southward included in an FHA loan payment?

A typical FHA loan payment includes chief and interest on the loan residual, mortgage insurance premiums, monthly homeowners insurance fees, and monthly property taxes. FHA homeowners in a condo or PUD will also take to pay homeowners association (HOA) dues every month.

Do FHA loans take higher monthly payments?

That depends. FHA loans crave mortgage insurance, which will increase your monthly mortgage payments. Simply then practise conventional loans with less than 20 per centum downward. The cheaper loan for you volition depend on your downward payment and credit score; if you accept not bad credit and 5 percentage down or more than, a conventional loan will likely have lower monthly payments. But if you have low credit and 3-3.5 pct down, the PMI on a conventional loan could be more expensive than FHA MIP. Talk to a lender to compare payment amounts and find out which loan is best for yous.

Tin can closing costs be included on an FHA loan?

Typically, the only closing price that can be included in an FHA loan is the upfront mortgage insurance premium (upfront MIP). Nigh other endmost costs, such as an underwriting fess or origination fees, volition need to be paid out of pocket when purchasing a dwelling house or using the FHA Streamline Refinance program.

What is the interest charge per unit on an FHA loan?

FHA mortgage rates are oft lower than rates for conventional mortgages. However, a lower interest charge per unit does not always equate to a lower monthly payment. FHA mortgage insurance will increase your payments and the overall cost of the loan, fifty-fifty if the base rate is lower than for other loan types. Looking at almanac percent rate (APR) can exist helpful in determining the 'true' cost of a loan, since Apr accounts for fees as well as interest.

Do all FHA loans take the same involvement rates?

No. FHA loan rates are not ready past the government, and they are not consistent from i FHA loan to the next. FHA-approved lenders get to set their own mortgage rates, and some may have more affordable pricing than others. In addition, rates can vary by borrower, with the everyman rates often going to the 'safest' borrowers, and higher rates going to borrowers with lower credit and other risky loan characteristics.

Can I get preapproved for an FHA loan?

Yeah, most FHA-approved loan providers can both preapprove and prequalify you for an FHA home loan. Getting prequalified is a less rigorous evaluation of your financial status, while a preapproval volition often require verifying fiscal details like credit score, debt-to-income ratio, and more. Typically, obtaining a preapproval letter from your loan officer will be of more value when house hunting because many sellers and real estate agents prefer to work with qualifying buyers.

How long until you can refinance an FHA loan?

FHA loans have a 210-day waiting menstruation earlier refinancing into another FHA loan using a Streamline Refinance, or refinancing into a conventional loan to remove the monthly mortgage insurance. This waiting menses is the same for VA loans, too. Whereas USDA loans have a 6-12 calendar month waiting period, depending on the circumstances. There is no waiting menstruation for refinancing a conventional conforming loan — unless you lot are tapping home equity with a cash-out refinance, which has a 6-month waiting catamenia.

Check your FHA loan eligibility

Many home buyers qualify for FHA — they just don't know it all the same. Check with a lender to verify your eligibility and find out how much house you lot can beget via the FHA mortgage program. You can get started below.

Verify your new rate (May 12th, 2022)

Sources:

2018 Freddie Mac Enquiry on Consumers

Source: https://themortgagereports.com/fha-loan-calculator

Posted by: scalfhiching.blogspot.com

0 Response to "How Much Money Do U Have To Make To Get A Home Loan Of $150,000.00 In Arkansas"

Post a Comment